Max Fsa Amount For 2025. Fsas only have one limit for individual and family health plan participation, but if you and your spouse are lucky enough to each be offered an fsa at work, you can each elect the maximum for a combined household set aside of $6,400. By leada gore, al.com (tns) the maximum contribution amount for employees participating in a flexible spending account will increase in 2025, according to the irs.

Irs increases fsa limits for 2025. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

By leada gore, al.com (tns) the maximum contribution amount for employees participating in a flexible spending account will increase in 2025, according to the irs.

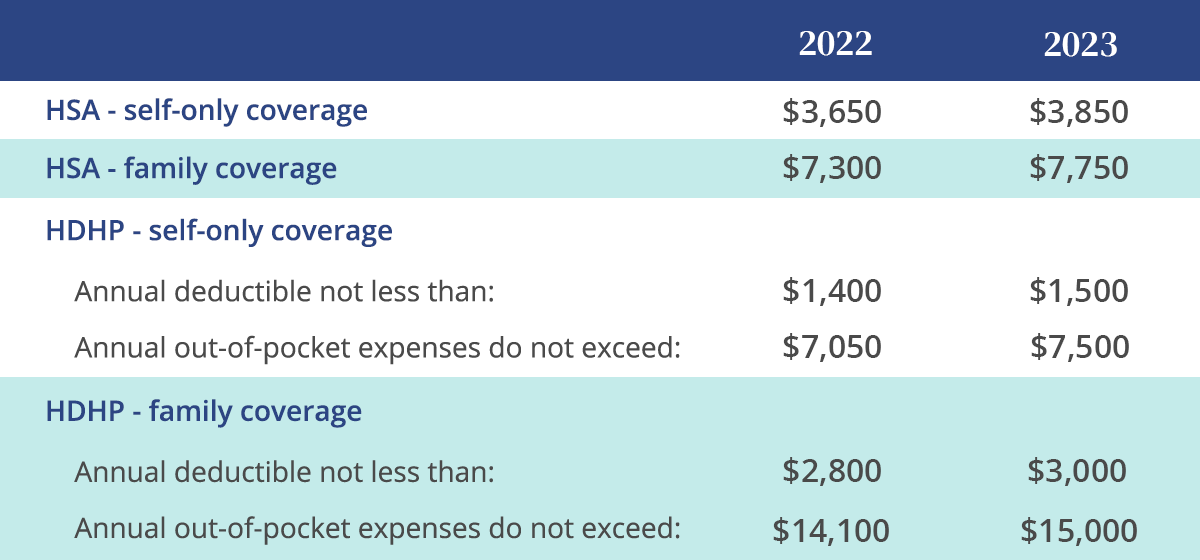

Irs Fsa Contribution Limits 2025 Paige Rosabelle, The irs raised the hsa contribution amounts more than usual for the 2025 calendar year due to. What is the 2025 maximum fsa contribution?

What Is The Fsa Max For 2025 Shena Doralynn, The fsa maximum contribution is the maximum amount of employee salary reductions per fsa. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

2025 Fsa Rollover Amount Lory Silvia, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below. For 2025 the irs defines a hdhp as one with a.

Fsa 2025 Eligible Expenses Bella Carroll, This amount has been increased. Fsa 2025 maximum amount gerty juliann, for unused amounts in 2025, the maximum.

Hsa Maximum 2025 Family Contribution Melly Leoline, The hsa contribution limit for family coverage is $8,300. The maximum contribution for family coverage is $8,300.

Maximum Fsa Contribution 2025 Nike Sabrina, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Therefore, in most cases the maximum health fsa amount available for plan years beginning on or after january 1, 2025 will be limited to $3,200 (max employee salary contribution) + $500 (max employer contribution, if offered) = $3,700 (combined).

Irs Maximum Hsa Contribution 2025 Hope Ramona, The irs raised the hsa contribution amounts more than usual for the 2025 calendar year due to. Fsa 2025 maximum amount gerty juliann, for unused amounts in 2025, the maximum.

.png)

Tabela Atualizado Irs 2025 Hsa Imagesee vrogue.co, For 2025 the irs defines a hdhp as one with a. The fsa maximum contribution is the maximum amount of employee salary reductions per fsa.

Whatâ s the Maximum 401k Contribution Limit in 2025? Hanover Mortgages, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. White st san pierre, in.

Fsa 2025 Maximum Amount Dasha Emmalee, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640.

The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.